Content

Quizzes and Answers

Quiz 1: Write a similar function to efficient_frontier_random_sampling in MyModule.py, but instead of printing out the risk and reward values on screen, store them in a pandas DataFrame and then use the plot.scatter (refer to documents of pandas) method of DataFrame to draw the two-dimensional risk and reward graph.

def efficient_frontier_random_sampling_df(money_spent, assets, asset_price, begin_date, end_date):

df = []

number_of_assets = len(assets)

random.seed(1234)

for counter in range(0, 1000):

numbers = random.sample(range(1,101), number_of_assets)

splits = np.array(numbers) / np.sum(numbers)

daily_return = portfolio_daily_return_with_multi_assets(money_spent, assets, splits, asset_price, begin_date, end_date)

reward = np.mean(daily_return)

risk = np.std(daily_return)

df.append(["portfolio{}".format(counter), risk*100, reward*100])

df = pd.DataFrame(df, columns = ["Name", "Risk", "Reward"])

return df>>> reload(MyModule)

<module 'MyModule' from 'C:\\code\\MyModule.py'>

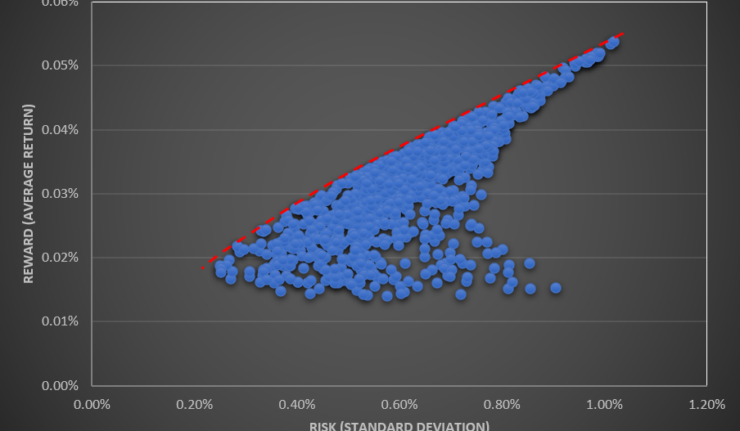

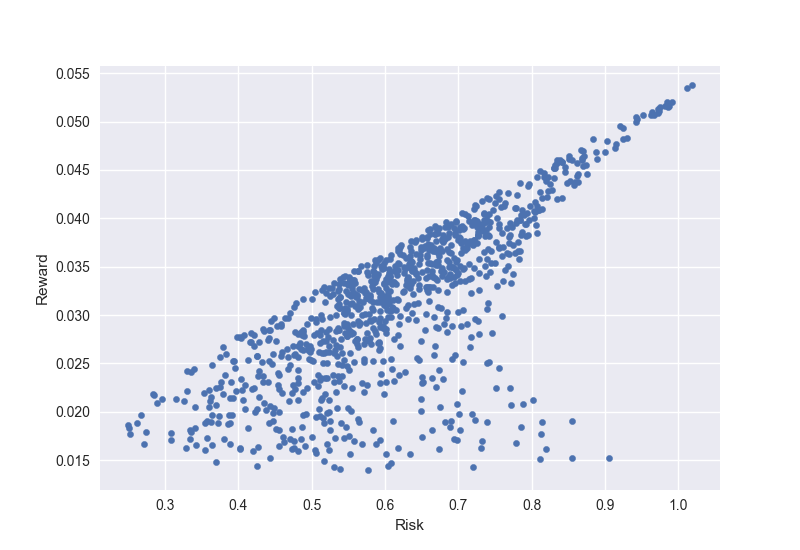

>>> ef = MyModule.efficient_frontier_random_sampling_df(1000, ["AGG", "GLD", "SPY"], AGG_GLD_SPY, "2011-01-03", "2020-12-30")

>>> ef

Name Risk Reward

0 portfolio0 0.38808 0.01884

1 portfolio1 0.98768 0.05157

2 portfolio2 0.79455 0.03824

3 portfolio3 0.94300 0.04994

4 portfolio4 0.42037 0.01596

.. ... ... ...

995 portfolio995 0.77378 0.03913

996 portfolio996 0.34104 0.02054

997 portfolio997 0.70922 0.04050

998 portfolio998 0.53586 0.03168

999 portfolio999 0.57203 0.02205

[1000 rows x 3 columns]

>>> ef.plot.scatter("Risk", "Reward")

<AxesSubplot: xlabel='Risk', ylabel='Reward'>

>>> plt.show()

Quiz 2: Use the following five assets: TSLA, WMT, SPY, AGG, and BTC-USD, download their price data between January 3rd, 2017 and December 30th, 2021, and use the new function you wrote from Quiz 1 to draw the risk and reward graph.

>>> assets = [ "TSLA", "WMT", "SPY", "AGG", "BTC-USD" ]

>>> asset_prices = yfinance.download(assets, start="2017-01-03", end="2021-12-30")["Adj Close"].dropna()

[ 0% ]

[******************* 40% ] 2 of 5 completed

[******************* 40% ] 2 of 5 completed

[******************* 40% ] 2 of 5 completed

[*********************100%***********************] 5 of 5 completed

>>> ef5 = MyModule.efficient_frontier_random_sampling_df(1000,assets,asset_prices, "2017-01-03", "2021-12-30")

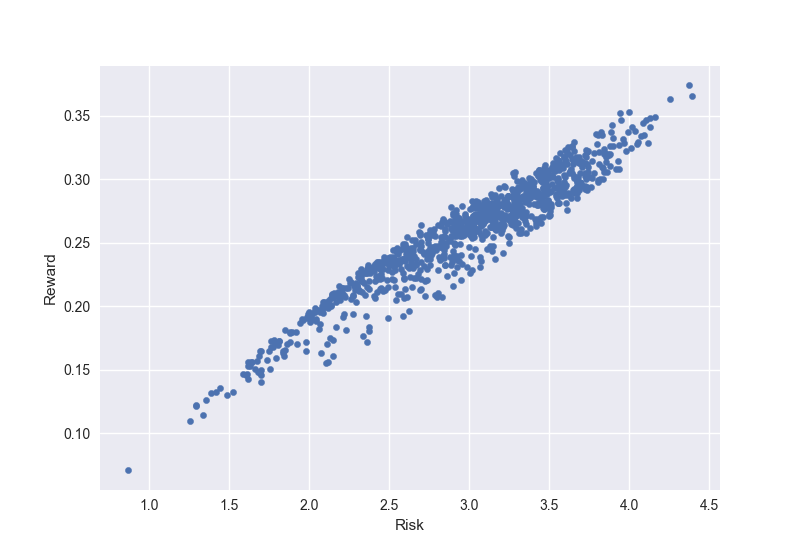

>>> ef5

Name Risk Reward

0 portfolio0 2.702368 0.263917

1 portfolio1 2.221947 0.208947

2 portfolio2 1.355244 0.125825

3 portfolio3 3.935484 0.308334

4 portfolio4 2.157222 0.210238

.. ... ... ...

995 portfolio995 3.035877 0.272421

996 portfolio996 2.274952 0.209166

997 portfolio997 2.935557 0.264528

998 portfolio998 2.315283 0.212965

999 portfolio999 3.293297 0.282250

[1000 rows x 3 columns]

>>> ef5.plot.scatter("Risk", "Reward")

<AxesSubplot: xlabel='Risk', ylabel='Reward'>

>>> plt.show()