Content

Quizzes and Answers

Quiz 1: Download the price data for TSLA between January 3rd, 2017 and December 30th, 2021, and calculate its daily returns using the shift(1) trick. Then calculate the reward and risk for each year between 2017 and 2021 using the daily return series.

>>> TSLA = yfinance.download(["TSLA"], start="2017-01-03", end="2021-12-31")["Adj Close"]

>>>

>>> TSLA_returns[TSLA_returns.index.year==2017]

Date

2017-01-04 0.046085

2017-01-05 -0.001057

2017-01-06 0.009967

2017-01-09 0.009912

2017-01-10 -0.006096

...

2017-12-22 -0.019478

2017-12-26 -0.024324

2017-12-27 -0.017807

2017-12-28 0.011937

2017-12-29 -0.012716

Name: Adj Close, Length: 250, dtype: float64

>>> TSLA_returns[TSLA_returns.index.year==2017].mean()

0.0016930879485460206

>>> TSLA_returns[TSLA_returns.index.year==2017].std()

0.02229355357696138

Loop through all years

>>> for year in range(2017, 2022):

daily_returns = TSLA_returns[TSLA_returns.index.year == year]

reward = daily_returns.mean()

risk = daily_returns.std()

print("{} {:.5f} {:.5f}".format(year, risk, reward))

2017 2.22936 0.16931

2018 3.68922 0.09320

2019 3.10686 0.13907

2020 5.62554 1.00467

2021 3.45503 0.22476Use a more efficient method

>>> TSLA_returns.groupby(TSLA_returns.index.year).mean() * 100

Date

2017 0.169309

2018 0.093199

2019 0.139070

2020 1.004672

2021 0.224762

Name: Adj Close, dtype: float64

>>> TSLA_returns.groupby(TSLA_returns.index.year).std() * 100

Date

2017 2.229355

2018 3.689215

2019 3.106863

2020 5.625540

2021 3.455028

Name: Adj Close, dtype: float64Quiz 2: Similar to Quiz 1, but do the same for the following five asset together: TSLA, WMT, SPY, AGG, and BTC-USD. Once you calculate the reward and risk for all assets of each year, plot two charts: one for reward each year of each asset, and the other for risk each year of each asset.

>>> assets = [ "TSLA", "WMT", "SPY", "AGG", "BTC-USD" ]

>>> asset_prices = yfinance.download(assets, start="2017-01-03", end="2021-12-30")["Adj Close"].dropna()

[ 0% ]

[ 0% ]

[ 0% ]

[ 0% ]

[*********************100%***********************] 5 of 5 completed

>>> asset_returns = (asset_prices / asset_prices.shift(1) - 1).dropna()[assets]

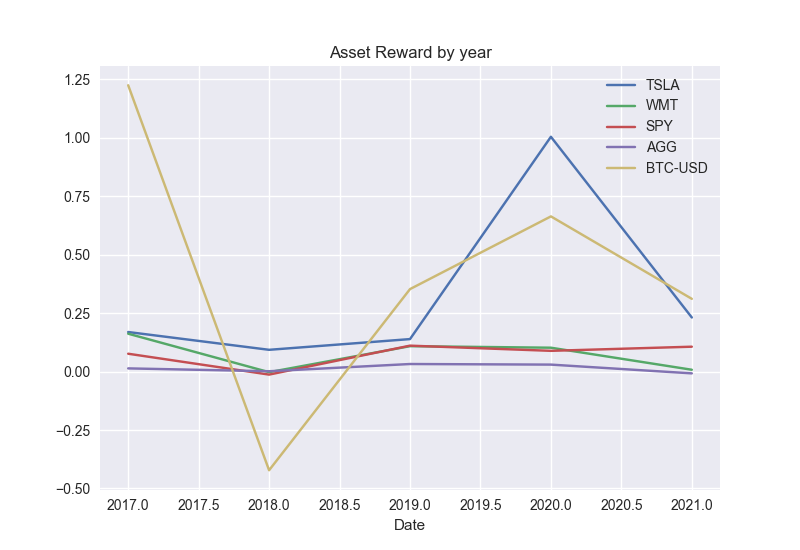

>>> reward_by_year = asset_returns.groupby(asset_returns.index.year).mean() * 100

>>> reward_by_year

TSLA WMT SPY AGG BTC-USD

Date

2017 0.169309 0.162110 0.076447 0.013709 1.225157

2018 0.093199 -0.002483 -0.012875 0.001487 -0.422106

2019 0.139070 0.108724 0.110990 0.032422 0.352910

2020 1.004672 0.102214 0.088811 0.029896 0.664032

2021 0.231498 0.007880 0.106543 -0.007610 0.311319

>>> reward_by_year.plot(title="Asset Reward by year")

<AxesSubplot: title={'center': 'Asset Reward by year'}, xlabel='Date'>

>>> plt.show()

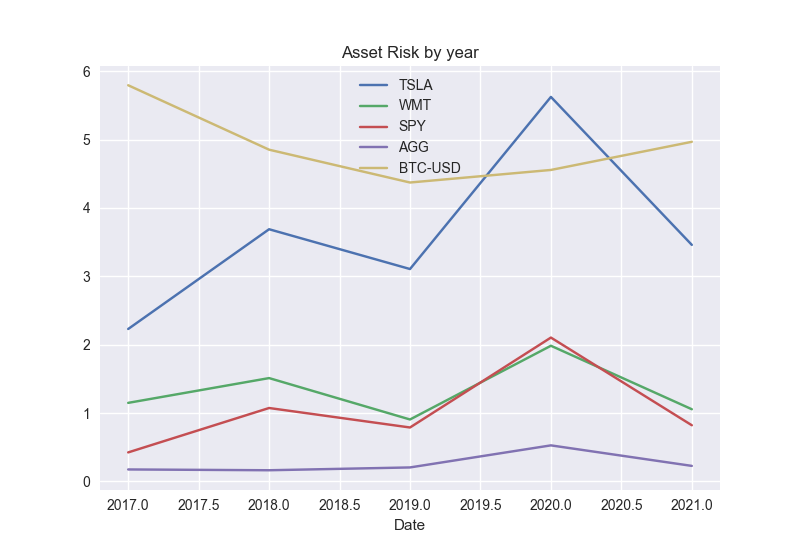

>>> risk_by_year = asset_returns.groupby(asset_returns.index.year).std() * 100

>>> risk_by_year

TSLA WMT SPY AGG BTC-USD

Date

2017 2.229355 1.148367 0.423439 0.173982 5.796219

2018 3.689215 1.511008 1.073218 0.162328 4.853322

2019 3.106863 0.905100 0.788112 0.203505 4.372890

2020 5.625540 1.984120 2.103876 0.526435 4.556687

2021 3.460307 1.055029 0.820825 0.226058 4.968553

>>> risk_by_year.plot(title="Asset Risk by year")

<AxesSubplot: title={'center': 'Asset Risk by year'}, xlabel='Date'>

>>> plt.show()