bt: https://pmorissette.github.io/bt/index.html

>>> import bt

>>> import yfinance

>>> import matplotlib.pyplot as plt

>>> prices = yfinance.download(["AGG", "GLD", "SPY"], start="2015-01-01", end="2020-01-01")["Adj Close"]

[*********************100%***********************] 3 of 3 completed

>>> prices

AGG GLD SPY

Date

2015-01-02 91.961433 114.080002 178.278488

2015-01-05 92.161308 115.800003 175.058868

2015-01-06 92.394440 117.120003 173.409973

2015-01-07 92.377808 116.430000 175.570923

2015-01-08 92.236275 115.940002 178.686417

... ... ... ...

2019-12-24 106.354485 141.270004 307.631104

2019-12-26 106.449127 142.380005 309.268738

2019-12-27 106.591095 142.330002 309.192078

2019-12-30 106.591095 142.630005 307.487427

2019-12-31 106.345039 142.899994 308.234406

[1258 rows x 3 columns]

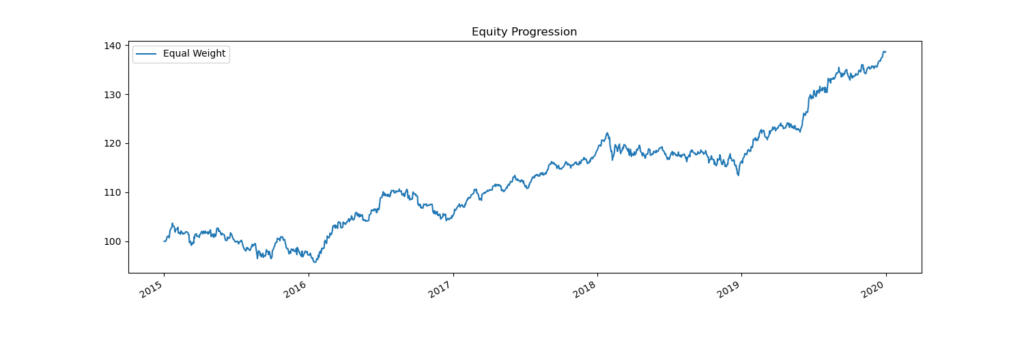

>>> strategy_eqwt = bt.Strategy("Equal Weight", [ bt.algos.RunMonthly(), bt.algos.SelectAll(), bt.algos.WeighEqually(), bt.algos.Rebalance()])

>>> backtest = bt.Backtest(strategy_eqwt, prices)

>>> result = bt.run(backtest)

>>> result.plot()

>>> plt.show()

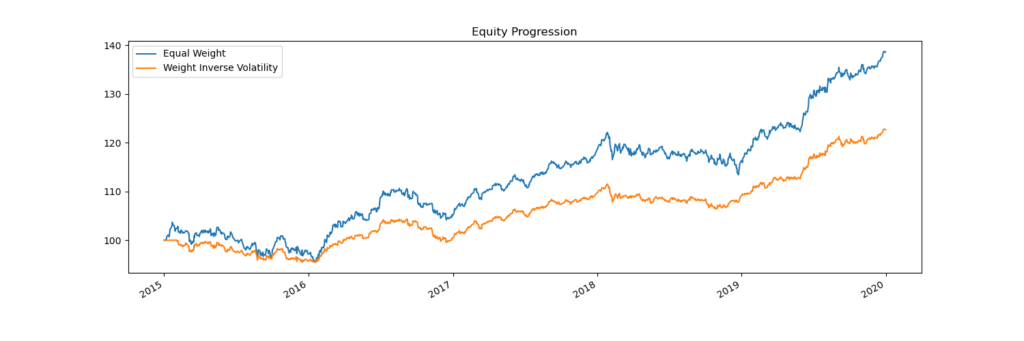

Compare two strategies

>>> strategy_invvol = bt.Strategy("Weight Inverse Volatility", [ bt.algos.RunMonthly(), bt.algos.SelectAll(), bt.algos.WeighInvVol(), bt.algos.Rebalance()])

>>> backtest_invvol = bt.Backtest(strategy_invvol, prices)

>>> result2 = bt.run(backtest, backtest_invvol)

>>> result2.plot()

>>> plt.show()

>>> result2.display()

Stat Equal Weight Weight Inverse Volatility

------------------- -------------- ---------------------------

Start 2015-01-01 2015-01-01

End 2019-12-31 2019-12-31

Risk-free rate 0.00% 0.00%

Total Return 38.64% 22.65%

Daily Sharpe 1.15 1.12

Daily Sortino 1.96 1.88

CAGR 6.76% 4.17%

Max Drawdown -7.68% -4.64%

Calmar Ratio 0.88 0.90

MTD 2.17% 1.37%

3m 3.97% 2.31%

6m 6.99% 4.80%

YTD 19.25% 12.41%

1Y 19.25% 12.41%

3Y (ann.) 9.56% 6.82%

5Y (ann.) 6.76% 4.17%

10Y (ann.) - -

Since Incep. (ann.) 6.76% 4.17%

Daily Sharpe 1.15 1.12

Daily Sortino 1.96 1.88

Daily Mean (ann.) 6.72% 4.16%

Daily Vol (ann.) 5.82% 3.70%

Daily Skew -0.17 -0.25

Daily Kurt 1.47 1.70

Best Day 1.50% 1.01%

Worst Day -1.59% -1.12%

Monthly Sharpe 1.07 1.08

Monthly Sortino 2.73 2.38

Monthly Mean (ann.) 6.36% 4.23%

Monthly Vol (ann.) 5.97% 3.93%

Monthly Skew 0.58 0.18

Monthly Kurt 0.03 0.07

Best Month 5.37% 3.27%

Worst Month -2.38% -2.27%

Yearly Sharpe 1.09 1.17

Yearly Sortino 11.91 34.18

Yearly Mean 9.55% 6.50%

Yearly Vol 8.76% 5.54%

Yearly Skew -0.45 -0.41

Yearly Kurt 0.32 -1.07

Best Year 19.25% 12.41%

Worst Year -1.60% -0.38%

Avg. Drawdown -0.93% -0.56%

Avg. Drawdown Days 30.77 26.20

Avg. Up Month 1.63% 1.05%

Avg. Down Month -1.07% -0.73%

Win Year % 75.00% 75.00%

Win 12m % 89.80% 87.76%